比特币超级预售募资额突破1200万美元

There is no doubt about Bitcoin's status as the most coveted cryptocurrency in the world. Today, investors of all sizes are racing to secure their share, with Michael Saylor's Strategy leading the pack with 629,376 $BTC.

Among the top Bitcoin holders are familiar names like Trump Media, owned by former President Trump, and Elon Musk's Tesla.

This significant interest from corporations and institutional investors has played a role in $BTC's climb to new highs. The U.S.'s pro-crypto policies have also had a positive impact.

Meanwhile, Bitcoin Hyper ($HYPER), a new Layer 2 DeFi-supporting coin project for $BTC, is currently attracting considerable attention. As Bitcoin enjoys a bullish rally, such upscaling solutions are gaining traction within the community.

Bitcoin Blockchain: Secure but Slow

When Bitcoin first emerged in 2009, it forever changed the financial industry. By leveraging blockchain technology, it ensured transparency, allowing anyone to verify transactions securely and preventing tampering with transaction records.

As a decentralized digital currency, Bitcoin operates without any central authority. Instead, a network of nodes validates transactions.

However, this setup has an inherent flaw: transaction speed. Bitcoin's native blockchain typically processes only 7 transactions per second (TPS), while Solana handles thousands.

This sluggish transaction speed leads to delays, with the Bitcoin ecosystem sometimes requiring minutes to hours for transaction confirmations. Additionally, the low TPS can drive up transaction fees, especially during network congestion.

Bitcoin's code has both strengths and weaknesses. Its simplicity makes it highly secure, but it also makes it difficult to adapt for modern high-throughput applications like NFTs and dApps.

Bitcoin Hyper ($HYPER): Speed, Lower Fees, and Expanded Utility for $BTC

Bitcoin Hyper ($HYPER) is a promising project aiming to develop a Layer 2 solution integrating the Solana Virtual Machine (SVM).

While modifying Bitcoin's code might seem like a logical way to address its limitations, it's far from simple. Attempts to simplify often compromise security.

This is why multiple projects have sought to solve Bitcoin's speed issues without sacrificing security.

Hyper, however, takes Bitcoin to the next level by introducing Solana-level throughput and smart contract capabilities.

Hyper's L2 will accelerate transactions and reduce costs by processing them off the Bitcoin blockchain. Since transactions are still settled on the Bitcoin network, security remains intact.

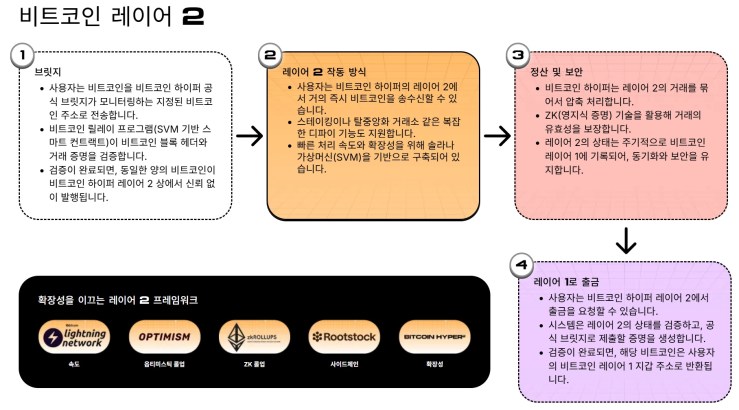

To better understand how L2 works, let's break it down:

Once the L2 launches, users can simply deposit $BTC into a designated Bitcoin address monitored by Hyper's Canonical Bridge.

The SVM then verifies the cryptocurrency, after which an equivalent amount of $BTC is minted on the L2.

By creating a wrapped version of $BTC, users can engage in activities like staking and dApp interactions—features unavailable on L1.

The SVM also ensures Solana-level speeds, far exceeding what the native Bitcoin blockchain can offer.

Cross-chain asset movement is another advantage. To return assets to the main chain, users simply submit a withdrawal request, and the funds are deposited back to their L1 Bitcoin address.

In summary, L2 enables faster and broader functionality than what Bitcoin L1 currently allows.

Learn more about Bitcoin Hyper's full guide.

Bitcoin Hyper ($HYPER) Presale: Bringing L2 to Life

The Bitcoin Hyper ($HYPER) presale is still underway. Early $HYPER purchases contribute to realizing the L2 vision and joining a rapidly growing community of bullish investors.

Holding the token also unlocks benefits within the Hyper ecosystem. At the most basic level, $HYPER can be used for fee payments and exclusive features.

Token holders gain voting rights, allowing them to influence the project's direction.

Priced at just $0.012805, $HYPER is one of the most affordable digital assets with significant growth potential.

Based on our Bitcoin Hyper price prediction, the token could reach $0.32 by 2025—a potential 2,400% increase from the current presale price.

If you're considering joining the presale, act fast—the next price hike is just hours away.

For passive rewards, staking $HYPER is an option. The project currently offers a 92% APY, though rates may adjust based on the number of tokens locked in the staking pool.

So far, the presale (ICO) has raised over $12 million, positioning it as one of the most promising presales of 2025.

Whale buyers have significantly boosted momentum, with purchases exceeding $52,000 in a single day. The largest single buy was $26,600, followed by two $12,900 purchases. Such activity has accelerated the presale's progress.

Buy Bitcoin Hyper tokens here.

A Brighter Crypto Future with Bitcoin Hyper

As it stands, the Bitcoin blockchain struggles to keep pace with faster chains like Ethereum and Solana. But solutions like Bitcoin Hyper ($HYPER) can bridge this gap.

Once launched, its L2 will offload transactions from L1, enhancing the speed and capabilities of the world's top cryptocurrency.

The recent whale activity and over $12 million raised prove the crypto market's high expectations for this much-needed upgrade.

This article is not financial advice. While $HYPER is a promising project, the crypto market is highly competitive and volatile. Always conduct your own research (DYOR) and invest wisely.

-

24\u5c0f\u65f6\u73b0\u8d27\u8d44\u91d1\u6d41\u5165/\u6d41\u51fa\u699c\uff1aETH\u51c0\u6d41\u51fa1.26\u4ebf\u7f8e\u5143\uff0cZEC\u51c0\u6d41\u51fa1820\u4e07\u7f8

2025-12-02 18:57BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u636e Coinglass \u6570\u636e\u663e\u793a\uff0c\u8fc7\u53bb 24 \u5c0f\u65f6\uff0c\u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u51fa\u699c\u5982\u4e0b\uff1a ETH \u51c0\u6d41\u51fa 1.26 \u4ebf\u7f8e\u5143\uff1b XRP \u51c0\u6d41\u51fa 1.16 \u4ebf\u7f8e\u5143\uff1b ZEC \u51c0\u6d41\u51fa 1820 \u4e07\u7f8e\u5143\uff1b COMP \u51c0\u6d41\u51fa 1126 \u4e07\u7f8e\u5143\uff1b DOGE \u51c0\u6d41\u51fa 1090 \u4e07\u7f8e\u5143\u3002 \u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u5165\u699c\u5982\u4e0b\uff1a BTC \u51c0\u6d41\u5165 2100 \u4e07\u7f8e\u5143\uff1b USDE \u51c0\u6d41\u5165 526 \u4e07\u7f8e\u5143\uff1b TRX \u51c0\u6d41\u5165 521 \u4e07\u7f8e\u5143\uff1b AAVE \u51c0\u6d41\u5165 328 \u4e07\u7f8e\u5143\uff1b HYPE \u51c0\u6d41\u5165 309 \u4e07\u7f8e\u5143\u3002 -

24\u5c0f\u65f6\u73b0\u8d27\u8d44\u91d1\u6d41\u5165/\u6d41\u51fa\u699c\uff1aETH\u51c0\u6d41\u51fa1.26\u4ebf\u7f8e\u5143\uff0cZEC\u51c0\u6d41\u51fa1820\u4e07\u7f8

2025-12-02 18:57BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u636e Coinglass \u6570\u636e\u663e\u793a\uff0c\u8fc7\u53bb 24 \u5c0f\u65f6\uff0c\u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u51fa\u699c\u5982\u4e0b\uff1a ETH \u51c0\u6d41\u51fa 1.26 \u4ebf\u7f8e\u5143\uff1b XRP \u51c0\u6d41\u51fa 1.16 \u4ebf\u7f8e\u5143\uff1b ZEC \u51c0\u6d41\u51fa 1820 \u4e07\u7f8e\u5143\uff1b COMP \u51c0\u6d41\u51fa 1126 \u4e07\u7f8e\u5143\uff1b DOGE \u51c0\u6d41\u51fa 1090 \u4e07\u7f8e\u5143\u3002 \u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u5165\u699c\u5982\u4e0b\uff1a BTC \u51c0\u6d41\u5165 2100 \u4e07\u7f8e\u5143\uff1b USDE \u51c0\u6d41\u5165 526 \u4e07\u7f8e\u5143\uff1b TRX \u51c0\u6d41\u5165 521 \u4e07\u7f8e\u5143\uff1b AAVE \u51c0\u6d41\u5165 328 \u4e07\u7f8e\u5143\uff1b HYPE \u51c0\u6d41\u5165 309 \u4e07\u7f8e\u5143\u3002 -

24\u5c0f\u65f6\u73b0\u8d27\u8d44\u91d1\u6d41\u5165/\u6d41\u51fa\u699c\uff1aETH\u51c0\u6d41\u51fa1.26\u4ebf\u7f8e\u5143\uff0cZEC\u51c0\u6d41\u51fa1820\u4e07\u7f8

2025-12-02 18:57BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u636e Coinglass \u6570\u636e\u663e\u793a\uff0c\u8fc7\u53bb 24 \u5c0f\u65f6\uff0c\u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u51fa\u699c\u5982\u4e0b\uff1a ETH \u51c0\u6d41\u51fa 1.26 \u4ebf\u7f8e\u5143\uff1b XRP \u51c0\u6d41\u51fa 1.16 \u4ebf\u7f8e\u5143\uff1b ZEC \u51c0\u6d41\u51fa 1820 \u4e07\u7f8e\u5143\uff1b COMP \u51c0\u6d41\u51fa 1126 \u4e07\u7f8e\u5143\uff1b DOGE \u51c0\u6d41\u51fa 1090 \u4e07\u7f8e\u5143\u3002 \u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u5165\u699c\u5982\u4e0b\uff1a BTC \u51c0\u6d41\u5165 2100 \u4e07\u7f8e\u5143\uff1b USDE \u51c0\u6d41\u5165 526 \u4e07\u7f8e\u5143\uff1b TRX \u51c0\u6d41\u5165 521 \u4e07\u7f8e\u5143\uff1b AAVE \u51c0\u6d41\u5165 328 \u4e07\u7f8e\u5143\uff1b HYPE \u51c0\u6d41\u5165 309 \u4e07\u7f8e\u5143\u3002 -

24\u5c0f\u65f6\u73b0\u8d27\u8d44\u91d1\u6d41\u5165/\u6d41\u51fa\u699c\uff1aETH\u51c0\u6d41\u51fa1.26\u4ebf\u7f8e\u5143\uff0cZEC\u51c0\u6d41\u51fa1820\u4e07\u7f8

2025-12-02 18:57BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u636e Coinglass \u6570\u636e\u663e\u793a\uff0c\u8fc7\u53bb 24 \u5c0f\u65f6\uff0c\u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u51fa\u699c\u5982\u4e0b\uff1a ETH \u51c0\u6d41\u51fa 1.26 \u4ebf\u7f8e\u5143\uff1b XRP \u51c0\u6d41\u51fa 1.16 \u4ebf\u7f8e\u5143\uff1b ZEC \u51c0\u6d41\u51fa 1820 \u4e07\u7f8e\u5143\uff1b COMP \u51c0\u6d41\u51fa 1126 \u4e07\u7f8e\u5143\uff1b DOGE \u51c0\u6d41\u51fa 1090 \u4e07\u7f8e\u5143\u3002 \u52a0\u5bc6\u73b0\u8d27\u8d44\u91d1\u51c0\u6d41\u5165\u699c\u5982\u4e0b\uff1a BTC \u51c0\u6d41\u5165 2100 \u4e07\u7f8e\u5143\uff1b USDE \u51c0\u6d41\u5165 526 \u4e07\u7f8e\u5143\uff1b TRX \u51c0\u6d41\u5165 521 \u4e07\u7f8e\u5143\uff1b AAVE \u51c0\u6d41\u5165 328 \u4e07\u7f8e\u5143\uff1b HYPE \u51c0\u6d41\u5165 309 \u4e07\u7f8e\u5143\u3002 -

\u6ce2\u573aTRON\u4e0eHTX\u5b8c\u62101000\u4e07\u6e2f\u5e01\u6350\u8d60\u5c06\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u6551\u63f4\u5de5\u4f5

2025-12-02 18:39BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u6ce2\u573a TRON \u521b\u59cb\u4eba Justin Sun \u5728 X \u5e73\u53f0\u53d1\u6587\u79f0\uff0c\u6ce2\u573a TRON \u4e0e HTX \u5df2\u5b8c\u6210\u5411\u9999\u6e2f\u7279\u533a\u653f\u5e9c\u652f\u6301\u7684\u5927\u57d4\u5b8f\u798f\u82d1\u63f4\u52a9\u57fa\u91d1\u6350\u8d60 1000 \u4e07\u6e2f\u5e01\uff0c\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u76f8\u5173\u6551\u63f4\u5de5\u4f5c\u3002 -

\u6ce2\u573aTRON\u4e0eHTX\u5b8c\u62101000\u4e07\u6e2f\u5e01\u6350\u8d60\u5c06\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u6551\u63f4\u5de5\u4f5

2025-12-02 18:39BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u6ce2\u573a TRON \u521b\u59cb\u4eba Justin Sun \u5728 X \u5e73\u53f0\u53d1\u6587\u79f0\uff0c\u6ce2\u573a TRON \u4e0e HTX \u5df2\u5b8c\u6210\u5411\u9999\u6e2f\u7279\u533a\u653f\u5e9c\u652f\u6301\u7684\u5927\u57d4\u5b8f\u798f\u82d1\u63f4\u52a9\u57fa\u91d1\u6350\u8d60 1000 \u4e07\u6e2f\u5e01\uff0c\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u76f8\u5173\u6551\u63f4\u5de5\u4f5c\u3002 -

\u6ce2\u573aTRON\u4e0eHTX\u5b8c\u62101000\u4e07\u6e2f\u5e01\u6350\u8d60\u5c06\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u6551\u63f4\u5de5\u4f5

2025-12-02 18:39BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u6ce2\u573a TRON \u521b\u59cb\u4eba Justin Sun \u5728 X \u5e73\u53f0\u53d1\u6587\u79f0\uff0c\u6ce2\u573a TRON \u4e0e HTX \u5df2\u5b8c\u6210\u5411\u9999\u6e2f\u7279\u533a\u653f\u5e9c\u652f\u6301\u7684\u5927\u57d4\u5b8f\u798f\u82d1\u63f4\u52a9\u57fa\u91d1\u6350\u8d60 1000 \u4e07\u6e2f\u5e01\uff0c\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u76f8\u5173\u6551\u63f4\u5de5\u4f5c\u3002 -

\u6ce2\u573aTRON\u4e0eHTX\u5b8c\u62101000\u4e07\u6e2f\u5e01\u6350\u8d60\u5c06\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u6551\u63f4\u5de5\u4f5

2025-12-02 18:39BlockBeats \u6d88\u606f\uff0c12 \u6708 2 \u65e5\uff0c\u6ce2\u573a TRON \u521b\u59cb\u4eba Justin Sun \u5728 X \u5e73\u53f0\u53d1\u6587\u79f0\uff0c\u6ce2\u573a TRON \u4e0e HTX \u5df2\u5b8c\u6210\u5411\u9999\u6e2f\u7279\u533a\u653f\u5e9c\u652f\u6301\u7684\u5927\u57d4\u5b8f\u798f\u82d1\u63f4\u52a9\u57fa\u91d1\u6350\u8d60 1000 \u4e07\u6e2f\u5e01\uff0c\u7528\u4e8e\u652f\u6301\u9999\u6e2f\u5927\u57d4\u706b\u707e\u76f8\u5173\u6551\u63f4\u5de5\u4f5c\u3002

查看更多

- 去中心化金融(DeFi)是什么-以太坊如何促进其成长 12-01

- 以太币是什么-与比特币有什么主要区别 12-01

- 如何参加Solana黑客松-开发者怎样才能获SOL币奖励 12-01

- Offchain Labs 针对Vitalik Buterin力推RISC-V的观点,提出以太坊L1采用WASM的方案 12-01

- 币安转到欧易OKX完整指南:提币与充币操作步骤全流程 12-01

- 币安转到欧易OKX完整指南:提币与充币操作步骤全流程 11-30

- Web3资产在哪个平台交易?Web3交易平台Top10推荐榜单 11-30

- Web3资产在哪个平台交易?Web3交易平台Top10推荐榜单 11-30

- Web3交易所APP推荐 十大热门Web3交易所APP盘点 11-30

- 加密货币分析师解释为何比特币处于典型熊市 11-30